China Foreign Investment Law was enacted and came into effect on January 1, 2020. It is a significant step of China in overhauling its piecemeal laws and regulations governing foreign investments in China in the past a few decades.

We have briefly introduced this law when it was published: China Foreign Investment Law and Cross-Border Inheritance and Estate Planning.

The first case reported by the media was decided by Shanghai First Intermediary Court in May of 2020 in which a foreigner successfully taken back the equity interests that were registered in the name of a nominee shareholder.

I. Facts of Case

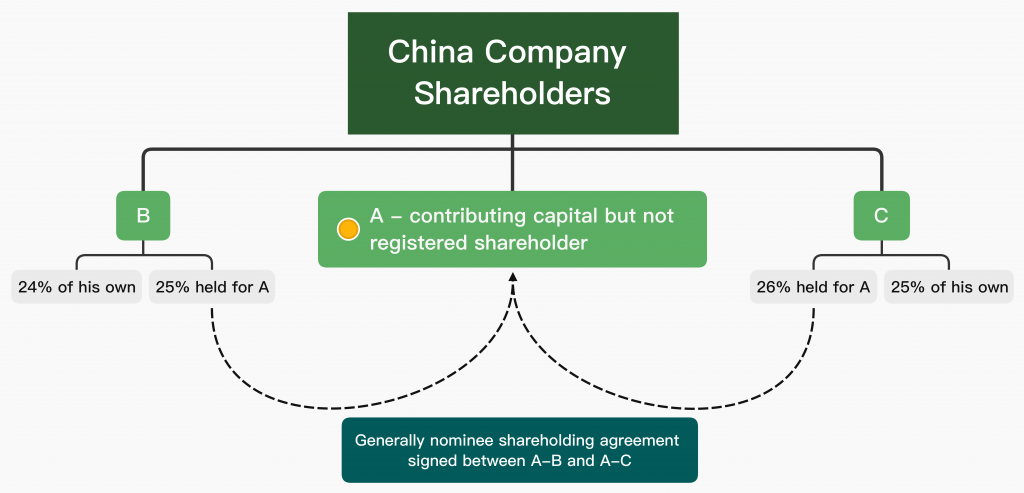

A used to be Chinese and emigrated outside of China and is now a foreign national. A has a brother B who is Chinese. C is Chinese and A’s business partner in China. A and C wish to set up a business in China. However, under old Sino-foreign Equity Joint Venture Law, C as Chinese citizen cannot set up a joint venture with A. C may only set up a new company and use that company to form a joint venture with A. To save time and trouble, A brought in his brother B to set up the desired business company with C. But 51% of RMB 1 million registered capital of this China business company was contributed by A out of which 26% was registered in the name of C, and 25% was registered in the name of B. In other words, A asked B and C to respectively hold 25% and 26% of equity interests in the business company for him. This is a typical nominee shareholder arrangement designed to circumvent some restrictive or prohibitive rules in China business investment arena.

The business is always run by A and C. Later, A and C started to have problems in their business operation. To prevent damage to business from the internal feud, A required C to transfer 26% of equity interests in the China company to B. After all, A trusted his own brother more.

The dispute arose here. C now claimed that he was the true owner of all 51% of equity interests/shareholding registered in his name. They went to court.

II. The Law and Legal Reasoning

Before the enactment of China Foreign Investment Law, Chinese citizens are now allowed to partner with foreign investors in setting up joint venture companies in China. So if A sued C to reinstate himself as a shareholder in the business company in question before the new foreign investment law, his claim would only fail since China court won’t make a decision in violation of China laws.

Now the new China Foreign Investment Law turns the table. This is why this case is meaningful for special attention.

Since A is a foreigner, and thus the case is a foreign-related lawsuit, the court first started with deciding on the applicable law in the case according to China Law on Choice of Laws. Of course, the applicable law is China Company Law and other relevant laws. Then the judge noticed the change of laws in that foreigner investors (both individuals or entities) and Chinese citizens can now set up joint venture enterprises/companies, and in the meantime, the business conducted by the company in question is of an industry which doesn’t restrict or prohibit foreign investment, thus the judge proceeded to rule that the 26% of the shareholding registered in the name of C as nominee shareholder shall be returned to A and this change of shareholdership shall be duly recorded on the company register.

III. Other Implications of China Foreign Investment Law

The changes brought about by the new China Foreign Investment Law are enormous, having far-reaching effect on foreign direct investment in China.

The new China foreign investment law allows a 5-year grace period for prior foreign invested companies to keep their current business forms and structures before they shall fully comply with the new law. However, it shall be noted that this doesn’t mean the old foreign investment laws are still be valid within this 5-year grace period in other aspects of foreign investments in China than corporate forms/structures. Put it another way, matters such as those in relation to equity transfer or share transfer in foreign invested companies or enterprises shall now be subject to the new Law including China Company Law by reference.

For example, equity interest transfer in a China-foreign joint venture company used to be much restricted, subject to both consent of all other investment partners and approval by local government department in charge of foreign investment in China, much higher a bar than that prescribed in China Company Law. With the repeal of old laws on foreign investment in China, the laws and rules governing equity transfer or share transfer in a joint venture company will be the same as applicable to domestic companies in China. Thus,

(1) consents of all other shareholders are no longer necessary, only half of other shareholders’ consents will do; those shareholders who don’t given consents shall have to purchase the equity interests or shares contemplated for sale. This ensures the exit by unhappy shareholders in a Sino-foreign joint venture company. We do notice that China Supreme Court, in revising its old interpretation of foreign investment laws after coming into effect of China New Foreign Investment Law, has not removed the wording of “unanimous consents of other shareholders”, but the same rule of “give consent, or purchase yourself” still applies, effectively leading to the same result as under China Company Law;

(2) no government approval for equity transfer or share transfer is necessary now. Under the old regimes, equity transfer in a foreign invested enterprise is always subject to approval of local governments, lacking which will result in non-effectiveness of the equity transfer contract or agreement. Now with the new regulatory framework, approvals by foreign investment departments are totally dispensed with even if foreign investors invest in businesses listed on the Negative Catalogue.

Such changes will surely boost merger and acquisition of foreign invested companies in China.

The national treatments accorded to foreign investors in making investment in China have apparently revived and improved foreign investors’ confidence in China economy which explains why China still saw a jump in foreign direct investment in China in 2020 amid the Covid-19 pandemic.

Comments