China markets are magnets to world business owners who want to sell their products to 1.4 billion Chinese consumers.

With China e-commerce developing so fast and pervasively that it has almost changed the mainstream shopping habits of Chinese society from bricks and mortars to online shops, to ride the tide, foreign businesses are looking into tapping that online market.

I. What Are Options for Foreign Sellers/Merchants

In the past, we received an inquiry from a cosmetic product manufacturer from the USA that wishes to sell their products to Chinese customers. Everyone is seeing how hot Chinese cosmetic market is now. While the foreign cosmetic producer wishes to sell products in China online, it doesn’t want to lose control of the sale channel, so it wants to go about the project on its own.

What are the options for it?

- Go onto Tmall.com (also known as Taobao in China) and open a shop there. This is almost a must-have tactic to online marketing and sale.

- Launch its own website to sell its own products and products it otherwise owns (those bought in for resale).

- Set up an online e-commerce platform just like T-mall or Amazon on which third parties can also sell products on its platform.

The third option is great but not really a viable option for a foreign merchant whose main purpose is to sell their own products in China.

So we focus on the first two options in particular the second one that is most sought by foreign merchants/investors.

II. Legal Implications

Foreign merchants that are engaged in cosmetic products have a lot of legal work to do before considering setting up their online sale arm. For example, cosmetic products shall have to pass the inspection of China National Medical Products Administration. A trading company by foreign investors shall meet the requirements of regulations on foreign investment in commerce business.

Here what bothers people a lot is the related regulation concerning foreign investment in China telecommunication sector, which is still heavily regulated and controlled with limited access by foreign investors.

- Catalog of China Telecommunication Businesses

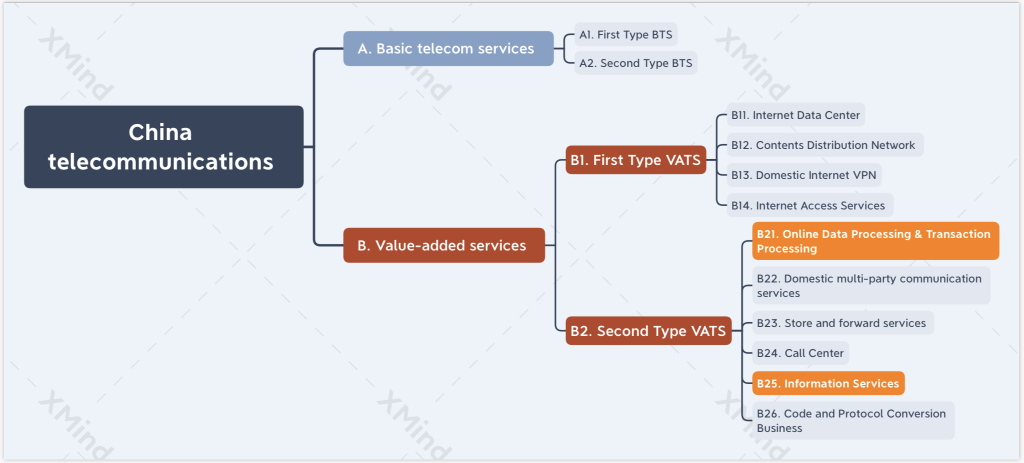

China Telecommunication Regulation (updated in 2016) classifies telecommunication business into two categories: basic telecommunication services and value-added telecommunication services. Both types of businesses require license for operation. The Regulation authorizes China Ministry of Industry and Information Technology to publish the detailed catalog of sub-classification of those two basic types of telecom businesses.

The basic telecommunication services are besides the point of our discussion here. We are more concerned with the value-added telecom services and its licensing rules, in particular B 21 and B 25 as indicated in the diagram above.

2. EDI License

EDI stands for electronic data interchange, referring to the type of VATS business like Amazon and Alibaba or Tmall e-commerce platforms on which goods and products and services are transacted between sellers and buyers, but the platform operators are not a party to those transactions.

In practice, there is not much confusion about this type of telecommunication business. Indeed, China MIIT has issued a notice in June 2015, allowing foreign investors to wholly own its EDI business entity in China.

3. ICP License

Much confusion arises in this area of value-added telecommunication business.

ICP means Internet Content Provider. In practice, it is closely related to B25 value added telecom services, namely, information services.

Besides the general rules in China Telecommunication Regulation (2016), China State Council has addressed the internet information service industry by promulgating a special regulation entitled “Administrative Measures on Internet Information Services” (amended in 2011). Under this special regulation, information services are further divided into two sub-classes: profitable information services and non-profitable information services. The former refers to provision of information for a fee and the latter for free. Profitable information service provision shall require a license for it be legal in China, but for non-profitable information service provision is subject a filing requirement which is a lot easier to meet. For example, this blog (if hosted in China) as a website provides general legal information for free, so there is no need for a license but I would need to file necessary information authority.

So if a foreign merchant launches a website selling their own products (by “their own”, I mean they own such products including those they purchase for resale) with fully functional e-commerce features (cart, payment, delivery tracking etc.), is this website a profitable information service, thus subject to a license by the government?

It has been a bit confusing and controversial regarding whether such a website needs a license, not just a filing. Indeed, authorities in different places and levels may give different answers.

Back in 2002, MIIT (or its predecessor) issued a written notice clarifying what shall constitute profitable information services: business activities involving visitors of the websites being required to pay a fee for viewing and downloading information provided thereon such as voice, texts, videos, data or pictures, or business involving the making of web pages for customers for a fee.

In 2010, China Ministry of Commerce issued a notice more squarely addressing the telecommunication license issue. Firstly it says that internet online sale is just the extension of sale activities of an enterprise, thus any foreign invested manufacturing or trading enterprises may engage in such business operation, and secondly it made it clear that foreign invested enterprises who employ their own online platforms for others to transact businesses thereon shall apply for the telecommunication license, but those who sell their own products on their online platforms shall need to do the filing with the authority.

It shall be noted that a license may be required if the foreign invested entities sell advertisements on their websites (used for selling their own products), so specific inquiry shall be made to local telecommunication authority for clarification.

III. Your Actions

For foreign investors who wish to tap China e-commerce market, it may be sensible to start and make your move earlier instead of later, despite there could still be policy interpretation problem in some places. A free trade zone in China will be a good place to land your project where preferential policies may be made available from time to time before being rolled out to other parts of China.

Comments