More than often, when you deal with a Chinese company, supplier, business partner or contractors, you are dealing with a China limited liability company incorporated under China Company Law. As a universal principle, the limited liability doctrine offers the “veil” protection for the shareholders or members of the those limited liability companies (hereinafter “LLC”) whereby the creditors of a LLC can only sue the company when collecting debts or demanding damages and if the company is insolvent, the creditors may have to file bankruptcy proceeding or see their money gone for good.

Of course, you may also hear of the “piercing or lifting corporate veil” doctrine which is the legal weapon often employed by corporate creditors to go after the shareholders who stand behind the corporate veil. However, in China, the application of the “piercing corporate veil” doctrine, fraught with immense confusion, ambiguity, is a lot more difficult than in the USA or other major jurisdictions.

So are there any other chances to hold the shareholders or even directors liable for unpaid or owed debts incurred by China companies? Yes, but depends.

I. Circumstances in Which Company Shareholders Caught Liable

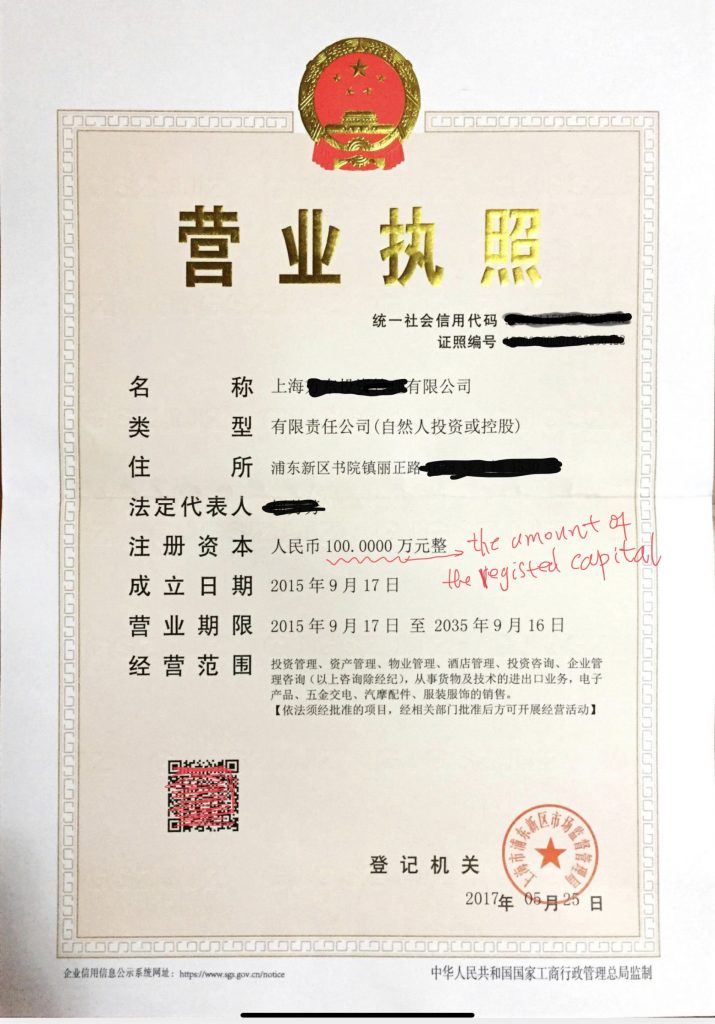

In a nutshell, where a shareholder fails to contribute its share of registered capital, or fails to make full contribution thereof, or withdraws capital after its contribution, creditors of the company can sue and request the company’s shareholders to bear the supplementary/complementary liability to compensate the creditors to the extent of debts and liabilities which the company is unable to repay or discharge and at the same time, to the extent of the amount of capital that is not contributed or not fully contributed or withdrew by the shareholders as well as interests accruing thereon.

1. Failure to Contribute Capital

The outright refusal, or other failures by the shareholder to contribute the capital are often clear and not difficult to prove. But in some cases mainly involving contribution in kind (as opposite to cash contribution), it may take some legal skills to find out whether such outright failures exist or not.

(1) where the shareholder intends to contribute property ownership or land use right or intellectual property rights as capital injection to the company but fails to effect the transfer of the such interests to the company, then creditors can sue to affirm the shareholder’s failure to make capital contribution and thus request the defaulting shareholder to assume the supplementary compensation liability.

In the course of litigation, the courts will direct the shareholders concerned to effect the transfer within a prescribed time period, and if the shareholder fails to make the transfer within the said time limit, the court will rule that the shareholder has failed to contribute capital and thus subject the shareholder to the supplementary compensation liability; if the shareholder then effects the transfer to the company within the said time limit, the creditor will now have new asset to go after to repay the debts owed by the company.

(2) a more secluded case is where the shareholder has contributed the land use right but the said land is allocated land (for more about allocated land, click here) instead of properly paid or often termed granted land use right, or the land is encumbered in the form of mortgage or otherwise.

In such cases, the creditors of the company can also request the court to affirm capital contribution failure on the part of the shareholder contributing such defective capital.

(3) in the case of contribution in kind by way of equity interests in another company (for example, shares in a listed company), the equity interests so contributed shall meet the following requirements: (a) the contributing shareholder legally owns the equity interests that are transferable; (b) there is no defects in or encumbrances on the equity interests; (c) the equity interests so contributed has been properly transferred in the name of the invested company; and (d) the equity interests have been duly evaluated. Absence of either (a), (b) or (c) would lead to supplementary compensation liability to the company’s creditors.

2. Failure to Fully Contribute

This mainly refers to cases where the capital in kind contributed is not evaluated or obviously over-evaluated. As a matter of law under China Company Law, any capital contribution in kind shall be appraised to ascertain its value. If a piece of contribution in kind is not evaluated, the company’s creditor shall have the right to request the court to affirm failure of capital contribution on the part of the shareholder making the said capital contribution. In the course of the litigation, the court will appoint a qualified evaluator to appraise the value of the capital in kind in question. If the evaluator’s finding is flagrantly lower than the value stipulated in the articles of association of the company, the shareholder will be ruled as having failed to make full capital contribution and therefore be subjected to the supplementary compensation liability to the extent of the difference between the finding and the stipulated amount in AOA.

3. Withdrawal of Capital Contribution

Prior to China reform on corporate registered capital regime in late 2013 (for more, click here), in order to incorporate a LLC company in China, promoter shareholders shall have to pay in 20% of registered capital at the time of incorporation with the remainder capital to be paid in over a period of two years (in most cases) after the company is officially set up. If we look back further to a time before the year of 2006 (when China adopted its first modern company law), all registered capital must be paid in 100% at the outset of the company incorporation, a system called “statutory capitalization” in academic world.

Given the stringent requirement on capital contribution to a company, many shareholders withdraw their paid-in capital immediately after the company is set up. In fact, there used to be commonplace phenomena whereby incorporating agencies advanced money to promoter shareholders for purpose of paying the registered capital and upon setup of the company, the capital is moved out of the company right away.

In reality, there are other ways to siphon or tunnel corporate capital out of a company thus constituting capital withdrawal, for example:

(1) artificially inflate company’s annual profits on corporate accounting books and then pay out such inflated profits to shareholders as dividends;

(2) fabricate credit-debt relations or deals to take corporate capital out of company;

(3) take out corporate capital through related transactions;

Such fraudulent practice has created a large number of companies whose registered capital has been withdrew and indeed has no or very little capital. In these cases, corporate creditors can turn to company shareholders to collect debts and courts will render such cheating shareholders to the supplementary compensation liability.

II. Corporate Directors or Officers Caught Liable

In relation to the shareholders’ supplementary compensation liability, in certain circumstances, corporate directors or officers may be ordered to assume joint and several liability with shareholders towards company’s creditors.

1. In the Case of Capital Withdrawal by Shareholders

Where the corporate directors or officers assist the shareholders in withdrawing the company’s capital, the company’s directors or officers shall be held jointly and severally liable to the creditors to the extent of the amount of capital withdrew and interests accruing thereon.

2. In the Case of Failure by Shareholders in Paying Capital Increase

Where a company increases its registered capital, and the subscribing shareholder fails to contribute its share in whole or in part, the corporate directors or officers may be held commensurately liable to company’s creditors provided that such directors and officers violate Article 147 of China Company Law leading to the failure by the shareholders in paying up subscribed capital increase.

This kind of cases may be very difficult to pursue as the plaintiff creditors have a very heavy burden of proof in order to hold the directors and officers liable.

Finally, creditors shall be fully aware of the “first come, first served” rule when pursuing the shareholders’ supplementary compensation liability as outlined above. In other words, if the relevant shareholder has assumed the said supplementary liability to a creditor, then other creditors shall not request the same shareholder to assume the supplementary liability again.

Please Contact me. I am from the US and bought goods from China. The company will not help or fix problem. They are selling product for high amount that does not work.

pls send us email with details of your contract and dispute with your China supplier.