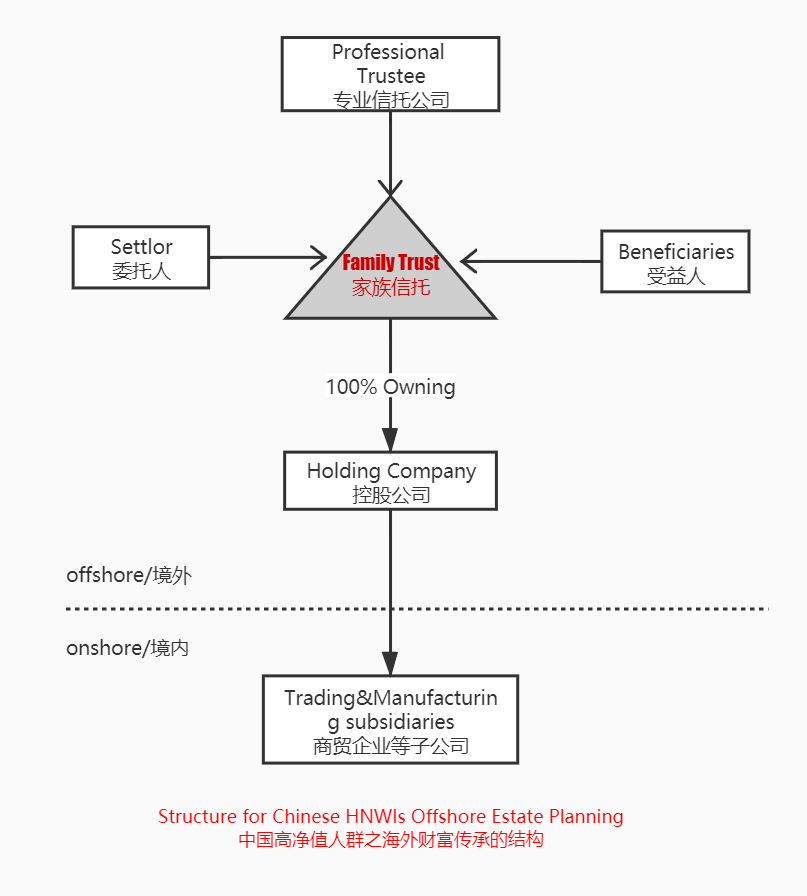

Cross-border Estate Planning: China Round-Trip Investment Rules

To many, estate planning is just a part of family law practice having li ...

an umbrella under which posts about Letter of Credit, Bank Bond/guarantee, international factoring, trade financing, international trade, dispute resolution, deal making, documents drafting