Estimated reading time: 5 minutes

Recently, one of our clients is involved in a thorny private lending dispute in China. In providing legal advice to the client, we searched the latest regulations and related cases from which we obtained some valuable information to share. Here we summarized the key points which should be paid attention to in private lending cases, for your reference.

Before we dive further into the topic, let us define what “private lending” in this post. Here by “private lending”, we refer to borrowing and lending money between and among individuals, corporations or unincorporated entities (other than financial institutions that are licensed to be engaged in loaning businesses). If you have a dispute with a bank, then these rules don’t apply.

Further, we are talking about private lending or loaning within China denominated in RMB (Chinese currency), and if you wish to know anything about debts or loans denominated in USD, then that is a different area of law in China: foreign exchange control.

- The New Ceiling on Private Lending Interest Rate

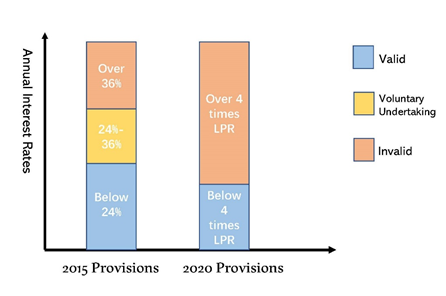

On August 20, 2020, China Supreme People’s Court issued newly revised Provisions on Several Issues concerning the Application of Law in the Trial of Private Lending Cases (hereinafter as “New Provisions”), which officially came into force on the same day. The New Provisions amended the judicial protection ceiling on private lending interest rates, setting the new ceiling at four times China’s one-year Loan Prime Rate (hereinafter as “LPR”) issued by the National Bank Funding Center on the 20th of each month, replacing the “two lines and three zones based on 24% and 36%” in the original provisions.

Since the one-year LPR released on July 20,2020 is 3.85%, the new ceiling on private lending interest rate is 15.4%. If the interest rate agreed upon by both parties exceeds the ceiling, the exceeding part is invalid and it will no longer be protected as natural debt, the debtor has the right to request the restitution of the interest on the part exceeding the four times one-year LPR. However, the launch of New Provisions was a bit hasty and whether these provisions had retroactive effect was still vague.

To improve and clarify the previous provisions, China Supreme People’s Court issued the second version on December 29, 2020, which officially came into force on January 1, 2021. In the second version, it is stipulated that if the private lending agreement has already been executed before August 20,2020, the prior version of 2015 Provisions[1] apply on the interests before August 20,2020 and the New Provisions apply on the rest.

2. The Invalidity of Private Lending Contracts

Another major change in the New Provisions is the modification of invalidity provisions. In Article 10, Article 11 and Article 12 of the second version of New Provisions, the basis of the invalidity conditions is Article 144, Article 146, Article 153 and Article 154 of Civil Code, instead of Article 52 of the expired Contract Law. Specifically, there are several conditions in which the private lending contract is invalid:

(1) contract concluded by a person who has no capacity for civil conduct shall be null and void.

(2) The contract concluded by persons of civil conduct and counterparties under false expression of intent are invalid.

(3) The private lending contract that violates the mandatory provisions of laws and administrative regulations shall be null and void except where the mandatory provision does not render the contract null and void. The contract that violates public order and good morals are null and void.

(4) Where a party colludes with another party to perform a contract that damages others’ legitimate rights and interest, such contract shall be null and void.

What’s more, Article 13 (3) is a new invalid condition added in New Provisions. It is stipulated that the people’s court shall determine that the private lending contract is invalid if the lender who has not obtained the qualification for lending business in accordance with the law provides loans to the general public for profits.

3. The Validity of Liquidated Damages Clause

In our case, both parties agreed on a penalty of prepayment (6% of the borrowed amount) in their private lending contract. The clause is valid under Article 30 of New Provisions.

We also found some judgements of the people’s court acknowledge the validity of such clauses in practice. A typical case is (2017) No. (20) 4435 of Guangdong Higher People’s Court. According to the principle of equity, the judge of the first instance considered that the debtor could repay the loan without any penalty. However, in the second instance, the judge concluded that both parties should perform in accordance with the contract, as it is stipulated in Article 30 of New Provisions. Moreover, the liquidated damages did not reach the level of “showing unfairness” and did not exceed the then ceiling of 24%, which should be supported.

However, if the default penalty is agreed, the sum of the interests, penalty and service fee claimed by the borrower must not exceed the ceiling of the annual interest rate of private lending (namely, 4 times LPR), and the excess part is invalid.

4. Conclusion

2020 was a hard year for everyone, including the foreign companies and foreigners residing in China. Many of them have been under financing pressure for a long time. Reducing the private lending interest rates to some extent can help companies and individuals get through their difficult times. However, there are still potential risks in the private lending contracts.

Understanding the latest regulations and judicial precedents on private lending is necessary for foreigners to protect their legal rights and interests. As a professional team leads by experienced Chinese lawyer from Landing Law Offices, we are privileged to help you to make the right decisions.

Comments