Insurances are popular in China. People in China rural villages are buying various insurance products, mainly, health insurance, and personal accident insurance. In urban population, many people buy life insurances (with dividend payout or investment components), and annuity insurance as well.

I. The Problem and Question We Have

On the other hand, life insurances are not cheap and often are only affordable to the rich families. The same is definitely true of China. Among Chinese rich families, there has been a long tradition of emigrating to western countries when they get rich like USA, Canada, Australia and even Singapore, or sending their kids to those western countries for education. Those kids are more likely to stay there than return to China.

In context of this post, how about the life insurances taken out by the Chinese parents (with parents being the insured) under whose policies the beneficiaries are often their children? What if the parents die and leave a big amount of insurance coverage to their children who have been naturalized in the foreign countries?

The focal point is whether such foreign beneficiaries will be able to take the insurance proceeds out of China?

This touches on China foreign exchange control law, which is very complicated indeed to common people who are not forex savvy.

II. China Foreign Exchange Framework

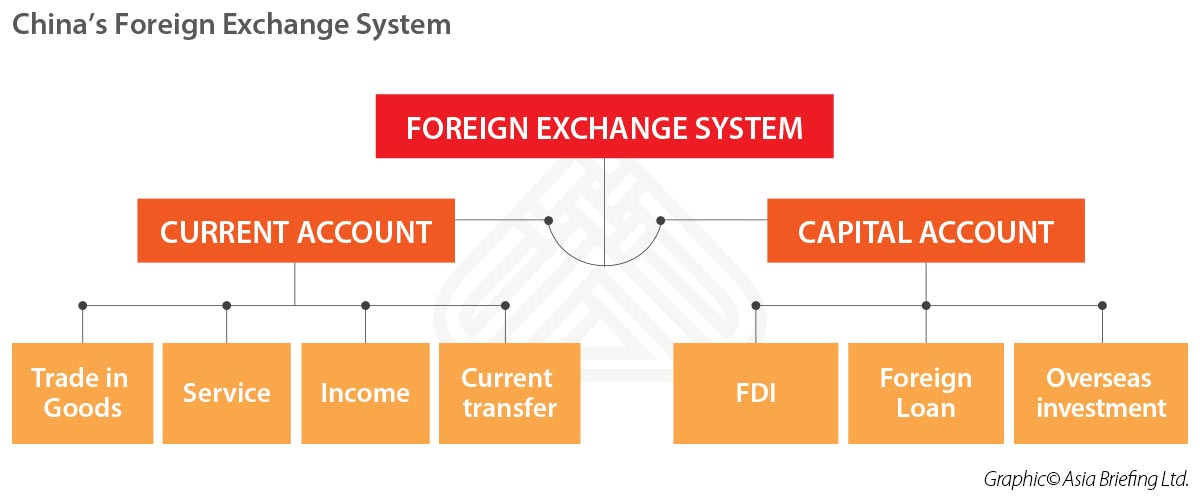

We won’t dive into China foreign exchange control laws and regulations, but it will clear some confusion in your minds if you understand the diagram below that explains the basic categories of foreign exchanges in China:

As shown in the diagram above, foreign exchanges are basically divided into two categories: current accounts, and capital accounts. Under current foreign exchange law, China has allowed free flow of current-account foreign exchanges so long as you can prove there are genuine underlying grounds, but for capital account foreign exchanges, there are still many restrictions (in various forms of approvals by China State Administration of Foreign Exchanges, SAFE) imposed on each item of capital accounts.

Unfortunately, the dividing line between current and capital accounts is not always clear in practice. Current accounts often include, without limitation, foreign exchanges in international trade of goods, services, and wages/salaries, business profits and other current transfers such as donation, family supports, IPR royalties, and capital accounts often refer to capital investments, securities investments and real estates.

What about proceeds of whole life insurances?

III. Our Findings of the Answers

We have not found any regulations, notices or rules directly addressing the question.

(i) Negative Official Stance

Unlike other areas of civil and business laws where you can do what are not prohibited by law, when it comes to foreign exchanges, one can only do what the law or regulation permits. You cannot go too far to infer or deduce an answer when you have a question about China foreign exchanges.

The latest regulation on forex current accounts is the Guidelines on Current Account Forex Businesses promulgated on August 28, 2020 from China SAFE. The regulation does have a special section devoted to address foreign exchange insurance businesses, but it covers only short-term health and accident insurances that often are associated with travels across borders. In other words, long-term life insurances are not considered as “current account” foreign exchange.

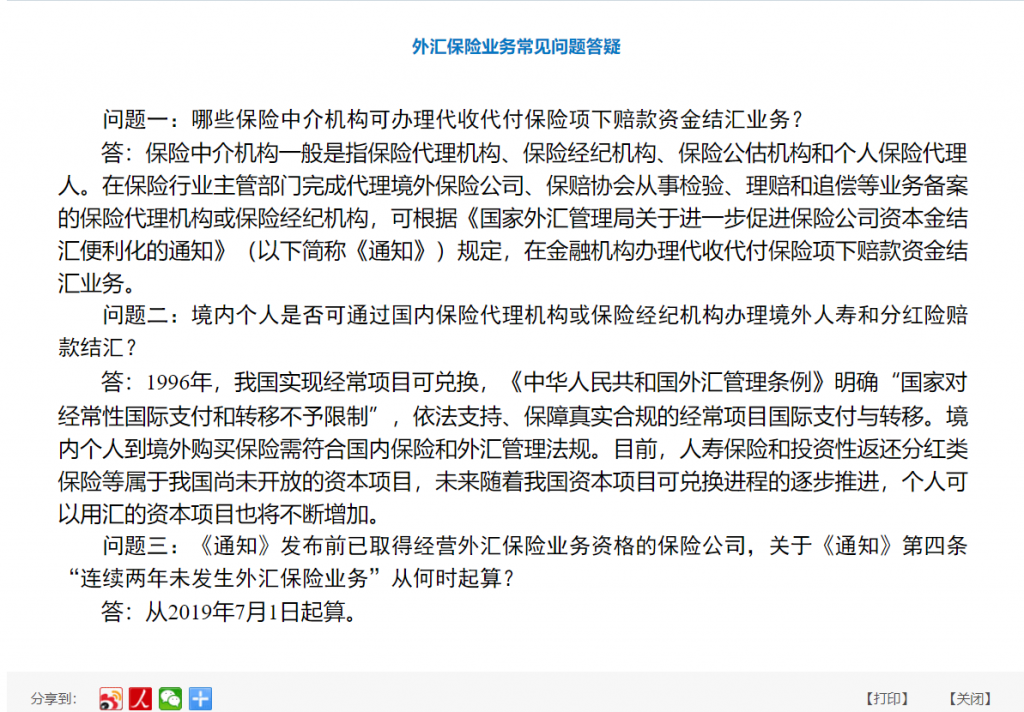

On China SAFE website, we see a Q&A page published on July 1, 2019, as follows:

In the middle, in the answer to Question 2, it says: at present, life insurances and insurances with investment returns and dividends are capital accounts which are not opened in China.

Our face-to-face inquiry to officials in China SAFE Shanghai Office elicited the same answer: the senior official straightforwardly dismissed any possibility of legally taking the life insurance proceeds out of China by foreign beneficiaries.

(ii) Positive Practice

So, it is a dead end? Not really, not certainly.

I am helping a foreign business lady in Shanghai to sort out and set up her estate planning for assets in China. She has been very successful cumulating tens of millions of RMB worth corporate equities, real estates and bank deposits and life insurances. The life insurances were purchased with RMB from a bank, and the designated beneficiaries are her children and other family members who are all foreigners. The client was assured by the bank that the beneficiaries will receive the insurance proceeds in their home country, meaning the RMB proceeds will be converted into USD which will in turn be transferred out of China.

The banker’s statement contradicting the law and regulations I found prompted us to visit China SAFE Shanghai Office, and got that negative answer described above.

During our research on the issue, we also found some “insurance experts” writing about this on internet, expressing positive attitude while qualifying their statement to the effect that it is not clear at law and in practice.

If the bank has done similar deals before as claimed by one of the bankers I approached, I believed that there must be a plausible legal provision that could be used to underpin such practice. Banking is a heavily regulated business in China.

Then I noticed a provision in Administrative Measures on Individual Foreign Exchanges coming into force back in 2007. Article 13 provides that legitimate RMB income of current accounts earned by foreigners can be converted into RMB and sent out of China. Since life insurance proceeds are not clearly provided in any law or regulation to be capital account, in such a blurred area, banks may venture to utilize this rule to support their practice. After all, insurance coverage paid by China insurance companies is “legitimate income”, what else could it be?

But hold on, it is “legitimate income”, but is it surely current account money? If it is not current account money, how come one can say the money can be converted into foreign exchanges and be transferred out of China?

Comments