China has enacted its long-awaited Foreign Investment Law this March but will only come into effect as of January 1, 2020. So far this law is warmly welcomed and hailed at large by the international communities.

Well, there are a lot of comments on the Law and its impact and implications on existing and future foreign investment in China. But hardly is there any commentator discussing the impact on cross-border estate planning on corporate assets in China that may turn into estate one day.

I. Issues Related to Inheritance of Corporate Shares in China Company

In the past, we have written a series of posts regarding inheritance of corporate shares and equity interests in a China company. Here are links for your reference:

- Inheritance of Corporate Shares in a China Company (I)

- Inheritance of Corporate Shares in a China Company (II)

- Inheritance of Corporate Shares in a China Company (III)

- Inheritance of Corporate Shares in a China Company (IV)

From those posts, you will know in the course of foreigner heirs inheriting corporate shares in a China company, the current issues are:(1) uncertainty about the nature of the company following the completion of the inheritance, i.e. registering the heirs as shareholders to the company; (2) from procedural point of view, if the company has other individual shareholders of Chinese nationality, then the inheritance will directly goes against the current foreign investment laws that prohibit Chinese citizens from being a party to a foreign invested joint venture company (except for Pudong New Area in Shanghai); (3) related to issue (1), what route if possible is there for the repatriation of corporate dividends out of China by the foreign heir shareholders.

II. Major Changes Brought by the Law

While there are a number of changes that are significant, we only focus on those that may affect our legal practice of estate inheritance and estate planning.

(1) What is Foreign Investment

The Law for the first time gives a clear and explicit definition on the term of “foreign investment” which is provided in Article 2:

“Foreign investment” in this Law refers to investment activities directly or indirectly conducted by one or more natural persons, business entities, or otherwise organizations of a foreign country (hereinafter referred to as “foreign investor”) within China, with the investment activities including the following situations:

1. a foreign investor, individually or collectively with other investors, establishes a foreign-invested enterprise within China;

2. a foreign investor acquires stock shares, equity shares, interests in assets, or other like rights and interests of an enterprise established within China;

3. a foreign investor, individually or collectively with other investors, invests in a new project within China; and

4. [foreign] investments in other forms as provided by law, administrative regulations, or by the State Council.

“Foreign-invested enterprise” in this Law refers to an enterprise which is wholly or partially[2]invested by foreign investor(s) and duly registered and established within China in accordance with Chinese law.

From the definition, it seems that a company in China is called a foreign invested enterprise simply for the reason that there is a foreign investor holding its equity interest. The definition has no mention of where the money underpinning the foreign investment shall come from, so a reasonable interpretation of the definition may be that it is the nationality of the shareholder in a company that dictates whether it is a foreign-invested company or a domestic one without reference to where the capital comes from.

In particular, the paragraph in bold and italic quoted above seems to be able to catch the situation where a foreign heir inherits the shares in a China domestic company which shares are owned by the deceased. In other words, when a foreign natural person acquires shares in a China company by virtue of inheritance, according to the definition, that company is now a foreign-invested company.

(2) What is National Treatment

Article 4 of the Law goes: with regard to administration of foreign investment, the State adopts a system of both pre-establishment national treatment and the negative list.

“Pre-establishment national treatment” means that foreign investors and their investments will be granted treatment no less favourable than that granted to Chinese domestic investors and their investments at the initial entrance stage of the investment. Foreign investors may not invest in fields where a “negative list” prohibits foreign investment, unless the investor meets certain conditions stipulated in the list.

While the Law doesn’t elaborate on concrete policies about such pre-establishment national treatment, apparently the unification of corporate setup and governance is one of them.

(3) Corporate Formation and Corporate Governance

Before this new Foreign Investment Law, China has been regulating foreign investments in accordance with its three separate foreign investment laws: Sino-foreign Equity Joint Venture Law, Sino-foreign Cooperative Joint Venture Law and Wholly Foreign-owned Investment Law. Especially, under the first two old laws, the foreign invested enterprises are not like a normal limited liability company since the old laws provide that the board of directors is given the highest power within the enterprises which power is generally vested in the shareholder meeting of the entity.

Now under the new Law, Article 31 provides:

The form of organization, the organizational structure, and the bylaws of foreign-invested enterprises shall conform to the provisions of the laws such as the Corporation Law of the People’s Republic of China and the Law of the People’s Republic of China on Partnership Enterprises.

So under the new Law, foreign invested enterprises are now within the ambit of China Company Law and China Partnership Enterprise Law in terms of their formation and corporate governance, eliminating those restrictions on the role and functioning of shareholder meetings.

(4) Ease of Moving Money Out of China

Article 21 of the Law says:

The capital contribution made by foreign investors within China, and the profits, capital gains, proceeds out of asset disposal, intellectual property rights’ licensing fee, indemnity or compensation legally obtained, or proceeds received upon liquidation by foreign investors within China, may be freely remitted inward and outward in RMB yuan or a foreign currency.

Moving money in and out of China has been a focal concern of foreign investors and foreigners having an interest in China. Frequently I receive inquiries about how to move money out of China. This Law seems to reassure foreign investors that their money has the way back home after it is invested in China. While this is a promising hope, the actual way leading to fulfillment of the hope is still muddy I guess, even against the backdrop that China has made efforts to pave the way for capital account convertibility.

The fear of free flow of capital account of foreign exchanges is always out there for China government, which could deplete the blood of China economy if not well put under control.

III. Impacts on Cross Border Estate Planning

In addition to clarifying confusion surrounding inheritance by foreign heirs of China corporate shares or equities, the main reason why I am interested in discussing the Law from the perspective of estate planning is the following:

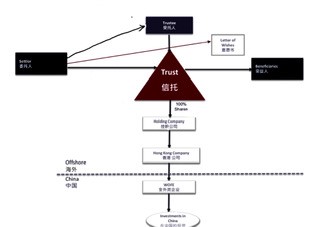

This is the typical structure a Chinese entrepreneur could employ to set up their family trust for purpose of estate planning whereby they don’t have to close their China mainland business and instead continue and maintain their business under trust structures for future generations.

The key is to help the Chinese client to set up an offshore trust in offshore jurisdictions (BVI, Cayman, Bermuda or Hong Kong) which will then set up an offshore entity to acquire the assets/business in China mainland, turning the China company (generally a domestic one running clients’ businesses) into a foreign-invested company, where the China Foreign Investment Law is relevant.

(1) With the national treatment and the unification of corporate setup under one set of rules as provided in China Company Law and China Partnership Law, now it will be no problem for a foreign individual heir to obtain shares or equity interests in a China domestic company and be shareholders with other Chinese individual shareholders. Before this, in most parts of China, Chinese individuals are not allowed to set up a company with foreign investors.

The ease of setting up a Sino-foreign joint venture company or a wholly foreign owned company will make it easier and smoother for Chinese clients to employ the trust structure (as shown in the chart above) to establish and install their own family estate plan offshore while keeping their China mainland business going.

(2) As indicated above, despite the detailed definition of foreign investment in the new Law, it remains unclear whether a China company with foreign shareholders who participate in the company as a result of inheritance of estate shares or equity interests should be considered a foreign-investment, transforming the original domestic company into a foreign-invested company.

Though an isolated case decided by a Shanghai court took the stance that it is the nature of the fund that dictates the nature of the company (in other words, if the fund forming part of the registered capital is brought into China from abroad, then it is foreign-invested company, otherwise the company remains a domestic one even if a foreign heir owns part of the registered capital that is initially invested from within China), it is still very controversial.

This uncertainty has a dire outcome for the foreign heir shareholders when they find themselves unable to repatriate corporate dividend out of China. So far, due to strict foreign exchange control, China does not allow a domestic company to remit corporate dividend out of China.

(3) While Article 21 of the Law makes a plausible promise of free moving of fund by foreign investors, it remains to be seen how that promise will translate into practice and reality.

At present, the Chinese clients, as individuals, still have no viable channel to remit big amount of money in one shot out of China for purpose of setting up offshore trust structure, and they need to really plan in advance to phase in the moving of fund offshore.

On the other hand, if the promise of free money-moving can come true in the future, it is good for the running and management of the whole offshore family trust in terms of distributing trust fund to beneficiaries of the family trust.

Overall, the new China Foreign Investment Law has something good to offer to estate planning industry targeting China mainland clients who may resort to the typical offshore trust structure for their family succession plan, but the real benefits may take time to show and to enjoy.

Hi Jason,

Does the term domestic company in your article refer to non-FIE China incorporated companies? Is this the definition taken from MOFCOM?

I’m asking because SAFE appears to define domestic company / domestic enterprise as all China-incorporated companies, which is a completely different definition.

Hi Mikao, correct, domestic company in this article refers to a company held by Chinese citizens and Chinese institutions. SAFE regulations must be read within its own definitions.