China property markets have somehow been tamed and reined in by its government in past a couple of years.

There have been quite some significant developments in property markets in major China cities, I mean the first-tiered cities like Shanghai, Beijing, Shenzhen and Guangzhou. Let us look at a few charts for your intuitive understanding.

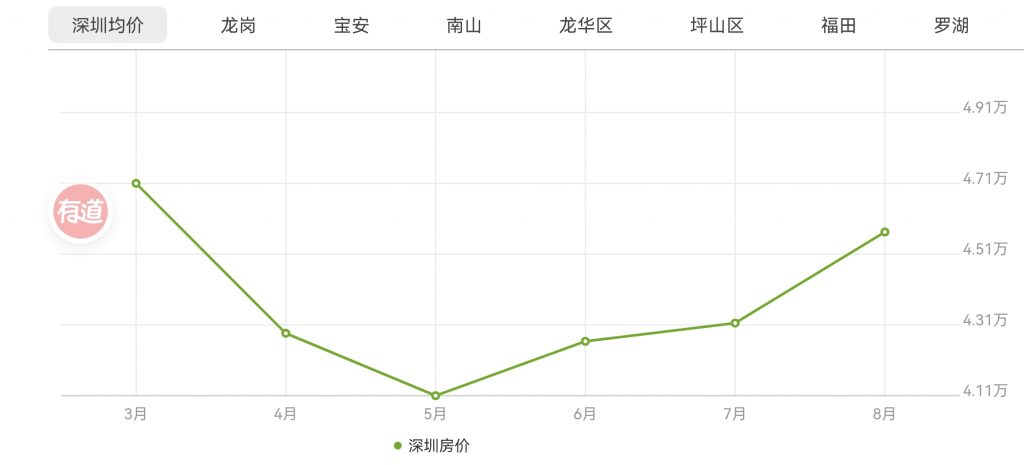

Take Shenzhen for example:

This chart is a snapshot of current pan-Shenzhen property market trend. On the left, the highest price appeared in March 2021, and hit the bottom in May and gained rising momentum till August (this month). Since it is a bird view of whole city property market, it doesn’t accurately reflect the true picture of certain district/area within its territory.

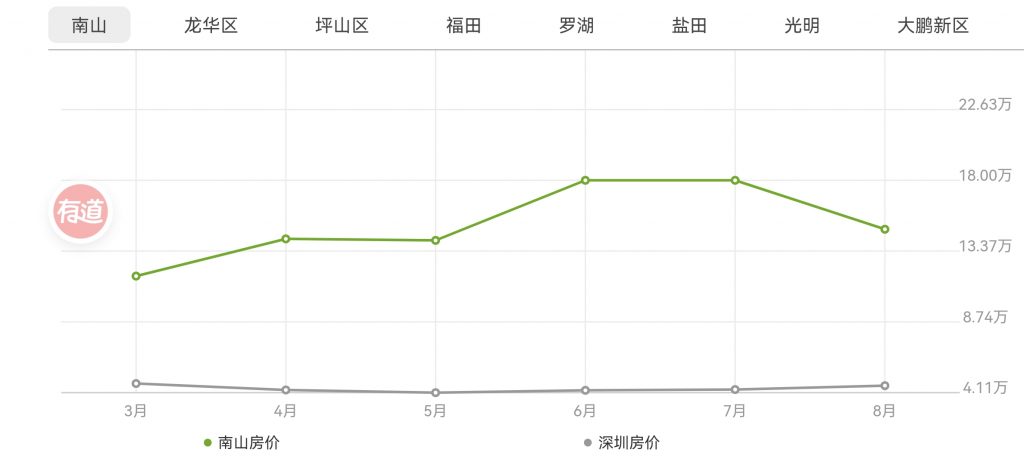

However if you take a look at what is going on in Nanshan District of Shenzhen, you see a different picture:

The green line represents property price in Nanshan district, and the gray line the whole Shenzhen property price. Nanshan has been very hot among property buyers in Shenzhen due to its position being the frontier of China reforms and opening-up testing ground, and Qianhai Free Trade Zone is located within its boundaries.

What’s more, there are a few local best schools located in Nanshan, and that means families flock there to secure a piece of property (however shabby or rickety it is) in order to get their children into those schools. You all know how Chinese parents view education for their children, they would sacrifice their lives to ensure their kids go to those good school. News said it that many good location properties are easily priced at over RMB 300,000 (USD 46,000) per sqm. Such news of this sort has misled many to believe the property market has an enormous potential, thus pushing more people to invest in property markets.

China government is watching.

Unlike American property markets that are left to rise and fall according to the law of free market principles, China governments are cautious about and very much averse to any possible collapsing aftermath of property markets which will probably end up with many families going broke. Social unrest and uprising may well be brewed ensuing any such property crash. The governing party CCP shall do everything to avoid it.

Years ago, the top paramount leader Mr. Xi Jinping made it clear that properties are for living purposes not for speculation. Despite the difficult economic plights caused by US sanctions by Trump Administration and covid-19 pandemic, China government has stuck to that property market rule proclaimed by China president and has not used the property market to stimulate and boost its economy.

Instead, as part of the efforts by China government to lower its people’s living costs with a view to encouraging birth rates in its society, property markets are squarely targeted. After all, housing and sheltering costs are the most burdensome for many Chinese families given the high property prices.

So Shenzhen, the first city in China, introduced a system of guiding prices for most properties within its territory, and requested that real estate brokers shall not publish asking prices higher than those guiding prices, and banks shall only extend mortgage loans based on those guiding prices. Those guiding prices are substantially lower than market values, esp for properties around good schools.

This is a big blow to local property markets. Buyers are suddenly finding themselves in severe financial pressure of having to come up with a lot more cash payments because they cannot get as much loan as before the curbing measure effected.

Recent news showed that a lot of realty firms have closed their shops to reduce operation costs, and may realtors have left the city for other places to make a living.

Comments