Many foreigners are aware that China has enacted rules restricting their purchase of real estate/houses/apartments. Foreigners are not allowed to buy more than one residential property (for self-using purpose only).

Very often foreigners asked me about whether they are allowed to own property in China as a result of gifting, inheritance from their family members. It is understandable that foreigners are somehow confused by Chinese government real estate policies as these rules are sometimes vague and unclear.

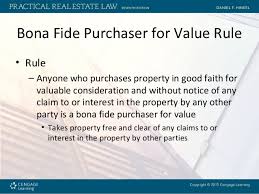

In practice, it is always permissible for a foreigner to obtain ownership in real estate/houses/apartments through gifting, inheriting/succession. A foreigner can even get real estate title by way of gifting from another foreigner with whom he has no familial relations.

There has been a flurry of regulations governing property gifting, esp, in terms of taxation.

Gifting between family members (between spouses, siblings, parents and children, grandparents between grandchildren) will mainly trigger deed tax and stamp tax only. As it is not a commercial transaction, business tax (subsequently renamed VAT tax) is exempted and as donor gains no income, gift-giver is not subject to any income tax either. However, compared with normal sale transactions of real estate, deed tax on gift-receiver in gift is higher, 3% of property value, the highest rate applied in Shanghai. In some other cities in China, deed tax can be up to 5% of the property value. To enjoy such tax benefits, parties shall have to present notarized evidence to prove the familial relationships.

However, gifting between non-family members is to be subject to heavy taxes. In particular, though it is also non-commercial transaction, business tax is levied at the rate of 5.55% of property value, a requirement designed to prevent tax escape. In addition, without familial relation, the donee will be subject to an income tax equal to 20% of the property value. Deed tax on the donee is also the highest rate. Moreover, when the gift recipient later sells the property, it will also subject to heavy personal income tax.

It shall be noted that under Chinese Contract Law, gifting can be conditional upon satisfaction of conditions by the recipient. Also, the donor may revoke his or her gift under certain circumstances, including recipient fails to satisfy the conditions set for the gifting, or fails to discharge his or her duty to support the donor, or that donee seriously infringes on the rights and interests of the donor or the donor close relatives. The law requires that the donor may only exercise this revocation right within one (1) year of being aware of the said circumstances.

Last, as you have seen from above, in China, in the case of a gift, income tax is imposed on the donee, and donor doesn’t pay any tax. This is because China doesn’t have gift tax and estate tax so far.

Dear Jason, is it still the case in 2025 that property (in Nanjing) can be inherited by a foreign relative who is also not living in China? If so, is there a limit to how long property can be owned in such a case? And is there a limit to the amount of properties that can be owned? I want to know what options I have (as only child) when I inherit property from my parents. Thanks, Peter

hi Peter, this policy has not changed, as a legal heir, you can inherit the properties your parents leave in China. No limit on ownership, and you can own it till you wish to dispose of it.