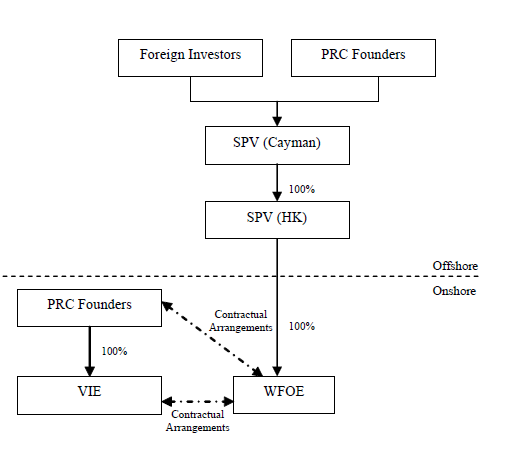

VIE entities in China have been pervasive in many industries in China, in particular, the telecom industry, advertising and some other asset-heavy industries like steel and mining. Below is a typical chart illustrating the VIE structure widely used in China.

In the chart, the VIE, generally a domestic entity holding necessary governmental license, is the operating platform of the whole VIE-based investment. In practice, through various contractual arrangements, the VIE entity is in the full charge of another entity, the WFOE (sometimes, JV), the wholly foreign-owned enterprise, which is further held via equity by offshore entity in HK and further by Cayman or BVI entity in the end. As a result of such absolute control, the VIE’s profits are siphoned completely by the WFOE all the way up to the offshore entities. Very often, to secure solid control of the VIE, except for those licenses that are not allowed to be held by foreign invested enterprise, substantial assets are owned/held by the WFOE or JV and are used by the VIE on leasing basis.

Given the aforesaid arrangements, the VIE while serving as the primary operating entity in conducting the businesses is equipped with little assets and is deprived of virtually all profits. In reality, a VIE company is de facto a shell after all. On the other hand, the VIE is the legal entity that assumes all the debts and other obligations incurred in the course of the business operation.

Now the problem comes. What if the VIE company defaults in respect of its financial obligations? Since the VIE is virtually just a shell, it is risky to deal with the VIE alone. There has been a decided case in Shanghai in which the creditor found itself in a hopeless situation though holding a winning arbitration award ordering the other party, a VIE, to pay it millions of RMB. The case exemplifies the pitfall in doing business with those VIE entities.

In the said case, the whole VIE-based investment is sold both onshore and offshore to new investors. In the post-acquisition reorganization and restructuring, all the operational assets that are operated by the VIE are transferred to the new buyer, leaving now the VIE company a real shell. Before the acquisition, the VIE has entered into a leasing contract with another company under which the VIE pays rental for using the video systems installed in many shopping malls throughout the countries in order to secure more advertising platforms. Upon the lessor company suing the VIE for payment of delayed rentals and damaged for contract termination, the VIE has already undergone a series of equity transfer following acquisition, resulting in the VIE held by another shell company, thus leaving the judgment creditor with nothing to go after to enforce its winning arbitration award. BTW, the VIE was transferred to last shareholder at a ridiculous price of RMB 10,000.

The hard facts speak for themselves. Companies dealing with VIE entities, such service provider, suppliers or other creditors shall vigilantly heed such risks once they are aware of their counter-parties being VIEs. A very reasonable and realistic option is to ask the WFOE or JV to guarantee the performance by the VIE, and in case the VIE defaults, the guarantor will be a comfort to the creditors.

In the case of absence of any guarantee by a third party, the only possible last straw at which a creditor may grasp is the “piercing the corporate veils” doctrine provided in China Company Law.

Article 20 of the Law provides that Article 20 Shareholders of a company shall abide by the laws, administrative regulations and the articles of association of the company and exercise shareholders’ rights according to law. Shareholders shall not abuse their rights as shareholders to impair the interests of the company or other shareholders, or abuse the independent legal person status of the company or the limited liability of shareholders to impair the interests of creditors of the company; it is further provided that, where the shareholders of a company abuse the independent legal person status of the company or the limited liability status of shareholders, evade debts and seriously impair the interests of the creditors of the company, the shareholders shall bear joint and several liability for the debts of the company.

However noting that the quoted clause is directed to regulate the shareholders of the company, courts may find it difficult to apply this provision in favor of the VIE creditors as the WFOE or JV is not the shareholder of the company. There will be difficult times for the lawyers to craft good strategies to help the creditors out by resorting to the “piercing corporate veil” theories.

If you have any further questions regarding the topic in this pose, you are welcome to contact the blogger for further discussion.

Comments