We should have written this post earlier.

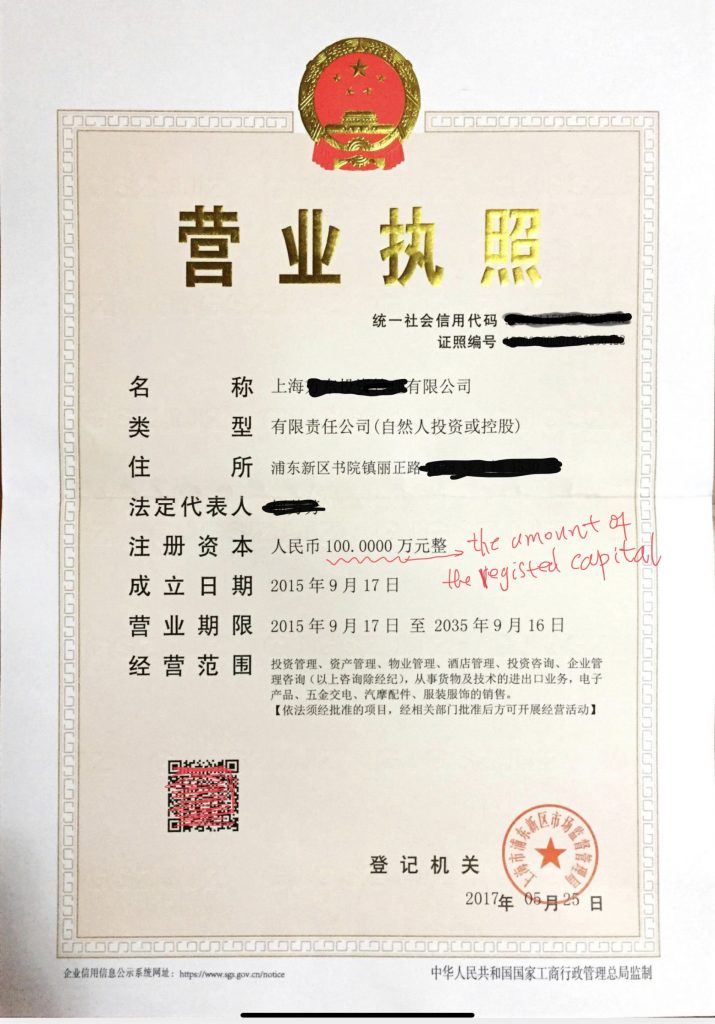

On this blog, in old posts, we mentioned the shareholder liability in regard of their subscribed capital contribution:

Can company’s creditors go after shareholders who have not paid up subscribed capital?

Registered capital, the greater, the better? Not really!

The main point is that a creditor of a company may go after the company’s shareholders who have subscribed to the company’s registered capital but have not paid it up to the extent of the amount of such unpaid capital.

The rule was initially provided in an interpretation by China Supreme Court of China Company Law back in 2010. Over the years, courts have found it unfair to shareholders who are said to enjoy the time benefits of deferring the payment of the subscribed capital, esp when the company may still have other assets available to repay its debts.

To balance the two opposing claims, China Supreme Court has issued new guidelines in applying this rule in judicial practice. Here is what it says:

在注册资本认缴制下,股东依法享有期限利益。债权人以公司不能清偿到期债务为由,请求未届出资期限的股东在未出资范围内对公司不能清偿的债务承担补充赔偿责任的,人民法院不予支持。但是,下列情形除外:

Under corporate capital subscription regime, shareholders have the time benefits therein. Where a company creditor requests shareholders to assume complementary compensation liabilities for the debts the company is unable to pay, to the extent of unpaid subscribed capital that has not come due, the people’s courts shall not support such requests, except as otherwise provided below:

(1)公司作为被执行人的案件,人民法院穷尽执行措施无财产可供执行,已具备破产原因,但不申请破产的;

where the company is subject to an enforcement proceeding and the court has exhausted all enforcement measures and found no assets available therefor, and the company is de facto bankrupt and doesn’t apply for bankruptcy;

(2)在公司债务产生后,公司股东(大)会决议或以其他方式延长股东出资期限的。

where, in the wake of the creation of the debts, the shareholders meeting resolve or otherwise decide to extend the term of capital contribution to company

So, the new guidelines have narrowed the application of the rules regarding corporate shareholder liabilities for debts incurred by the company they invest, making it more difficult for creditors to go after corporate shareholders.

In other hand, this equally means that it is riskier to deal with limited liability company in China that is often undercapitalized and used for defrauding creditors, in particular, foreign creditors.

However, while it is no longer advisable to sue a company’s shareholder based on the unpaid subscribed registered capital when a creditor sues the company, as indicated in circumstance (1) of the new guidelines from China Supreme Court, a creditor who successfully obtains a winning judgment against a China company may still have a chance to tap the pockets of the indebted company’s shareholders provided that in the court enforcement proceeding, the company is found to have no other assets to meet the obligations in the judgement and its shareholders owe a duty to pay up their subscribed registered capital of the company.

Actually, back in November of 2016, China Supreme Court issued a judicial interpretation on rules for changing and replacement of parties to the enforcement proceeding (a proceeding referring to that for enforcing an existing valid court judgment). Under this interpretation on enforcement, according to its Article 19, if a shareholder has failed to pay up the registered capital he subscribed in the company that is subject to the court enforcement proceeding and has no assets available to meet its judgment debts, then the judgment creditor may apply to court to add or substitute such a shareholder (for the indebted company) to the enforcement proceeding to pay the company’s debts to the extent of the amount of unpaid subscribed registered capital of the company.

Here is the example for illustration purpose only: Tom is a shareholder in a China company, and the registered capital of the company is RMB 5 million, and Tom has subscribed 20%, i.e. RMB 1 million. But Tom has never paid a penny to the company as his contribution of his subscribed registered capital. If the company is ordered by court to pay RMB 1.5 million to a creditor, then in the enforcement proceeding, the creditor can add Tom as a party subject to the enforcement proceeding, and if approved by the enforcement court, Tom will be ordered to pay RMB 1 million to the creditor.

Lastly, there is the issue of how to add and substitute shareholders to pay corporate debts in court enforcement proceeding. The 2016 Supreme Court interpretation addresses this as well. If the fact of failure on the part of shareholders to pay up their subscribed registered capital is firmly established and no dispute over it, the court may directly decide to add and substitute such shareholders to pay the corporate debts. However if there is serious dispute in proving the failure, then the court may organize a hearing to decide on the issue within 60 days. The shareholder may institute a separate legal action to challenge the attempt of the enforcement court to catch him for paying the corporate debts. So the road for corporate creditors to pursue the liabilities of the corporate shareholders in regard of their liability to pay up subscribed registered capital may prove to be bumpy.

Comments