It is no longer that hot as it was a couple of years ago. I mean the variable interest entity, VIE.

For many, VIE may seem strange to them since the VIE structured investments have mainly emerged as big investments involving companies listed in world stock exchanges in New York, Hong Kong and Singapore. Here is the brief introduction for rookies.

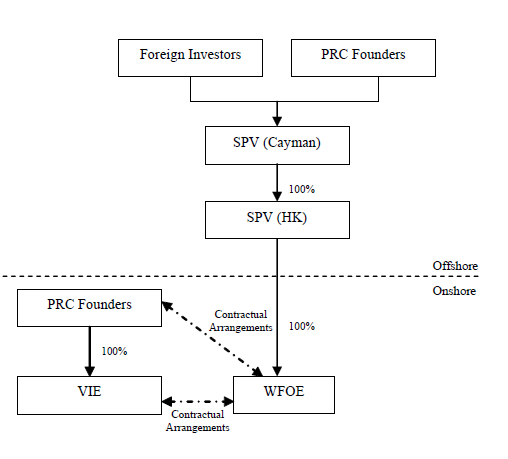

This is a typical structure where foreign investors employ to circumvent Chinese restrictive regulation in certain industry such as telecommunication sectors. In this chart:

(1) the VIE refers to the Chinese company that is licensed in China to conduct relevant business that is not accessible by foreign investors.

(2) the WFOE refers to the company, generally a consultant company, that is controlled by foreign investors via their equity vehicle, SPV, in HK .

This WFOE is designed and created soley for purpose of controlling the VIE and taking away profits generated by the VIE through various kinds of agreements, such as agreement for WFOE to provide senior management personnel to VIE, agreement under which WFOE leases assets to VIE, consultancy agreement under which VIE will pay money to WFOE.

In practice, this WFOE can be a joint venture between a the foreign investors and Chinese parties. In the ongoing project I am working on, clients have set up a joint venture with the Chinese founders of the VIE. Meanwhile, the VIE is held by the persons designated by the foreign investors, which puts another safety belt for the foreign investors.

(3) the HK SPV is generally set up to take advantage of the special tax arrangement made between HK and mainland China.

(4) SPV Cayman is often the legal entity that is planned to be listed on foreign exchanges. Very often the PRC founders of the VIE hide themselved behind another BVI SPV which holds equity interests in the Cayman SPV.

Though VIE structured investment is designed for purpose of overseas listing of Chinese assets, for foreign investors that may not be that ambitious to build a listed company, the VIE may offer some lights on investing in some of the industries in China in which foreign investors are kept away.

For example, the English training business is a hot area many foreign investors want to take a slice of the big cake. However, foreign investors are de-facto prohibited from making investment in this area. VIE structure may offer a practical way of investing in this area. In fact, China’s home-grown training giant, New Oriental, has gone listed in USA by way of VIE.

In the VIE structure, foreign investors shall be careful in setting up a new VIE or acquiring an existing VIE entity. The key issue is that you need to find a person you can fully trust to hold the VIE for you. In the typical VIE structure, the PRC founders as shown in the chart are aligned with the foreign investors by both holding equity interests in offshore entity. But for retatively small-scale VIE investment, the offshore structure may not be that complicated as in the typical VIE. So the alignment of Chinese parties’ interest with foreign parties is critical issue. In part, this can be achieved by property incentive arrangement offered to the Chinese parties.

For small VIE investment, the reason for the foreign investors to have a HK SPV in place is to ensure that the profits taken from the VIE will have a legal channel to get the money out of China.

Again, VIE has some inherent legal flaws in its structure, and this is not a perfect investment instrument, but rather a “have-to” practical option. So long as the VIE is not going to be listed abroad, it won’t trigger foreign investment scrutiny. The best way out of the investment is to sell the business at premium price to others when the business has grown big and promising.

Comments